🚀 Explosive ESG Market Growth Goes Undercover!! SHHhhh!!

5/20/25

ESG—The Silent Powerhouse in a Shifting World

By Denise E. Hewes

ESG investing is booming—rising from $500B to over $3.25T globally in just six years—despite political pushback. This article explores the role of key players like OECD, PwC, Morningstar, and BlackRock in shaping the evolving ESG landscape, highlighting both credibility and concerns over ethics and verification. As sustainable finance scales globally, staying informed and adaptable is essential for investors and changemakers alike.

Medium:

https://medium.com/@saf_72881/explosive-esg-market-growth-goes-undercover-shhhhh-1a887f39643c

LinkedIn:

https://www.linkedin.com/pulse/explosive-esg-market-growth-goes-undercover-shhhhh-denise-hewes-lfihc

https://10xsfl.com/news/f/🚀-explosive-esg-market-growth-goes-undercover-shhhhh

https://www.google.com/search?q=SFL+LLC+Simple+Full+Life,+Denise+E.+Hewes&stick=H4sIAAAAAAAA_-NgU1I1qDAxSTQwSDUySjZITDRJMzS2MqhItUhNMk8zMUpJTjE0TTW3XMSqGezmo-Dj46wQnJlbkJOq4Faak6Pgk5mWqqPgkpqXWZyq4Kqn4JFanloMANuKm5lVAAAA&hl=en&mat=CZzdE7ktrJk-ElcBYJahaYnk9oNvrPb-lU0t1k37aqi-bTO46rHL0EdjVc54oKmWXcfxcSXk1Nct-f5h8x5iBGnxHKtdhwZ8-L72gN5JdH8P9sjutYKhROvHVL6G7KlvCOE&authuser=0#lpstate=pid:2863628890630668539

🎥 1-Minute Video Drop!

“6 Silly Low-Tech Summer Cool Down Hacks” 😅

5/12/25

This might be the most C-grade pretending to be B-grade thing I’ve ever created. Sharknado-level inspiration, Attack of the Killer Tomatoes-level logic, and 100% homemade with InVideo AI.

❄️ Because when the temps rise, your electric bill shouldn’t.

So tell me…

👉 What’s your ridiculous, low-tech way to beat the heat without turning on the A/C?

🤔 Would you stand in front of a car wash?

👵 Eat frozen yogurt with your grandma (because her teeth lasted!)?

🐊 Accidentally cannonball into the wrong zoo pond?

🏖️ Or remote-work from a beach claiming “seashell R&D”?

Drop your funniest ideas in the comments or tag a friend who’s already living the no-A/C life.

#LowTechCoolDown #BGradeEnergyTips #SustainabilityHumor #ClimateActionCanBeFun #LinkedInLaughs #NoACNoProblem #SummertimeSilliness #CarbonCuttersUnite

✈️ Sky-High Risks:

Are Airplanes Built for Today’s Weather—Not Tomorrow’s?

4/19/25

By Denise E. Hewes

Climate change isn’t just affecting our homes and insurance policies—it’s posing serious questions about the safety and resilience of the aircraft we rely on. As extreme weather events become more frequent and severe, it’s imperative to ask: Are our airplanes designed to withstand the challenges of a changing climate?

Global passenger traffic is anticipated to grow at a compound annual growth rate (CAGR) of 3.6%, reaching 244% of 2019 levels by 2050. ACI World

🌡️ The Growing Threat of Extreme Weather

In the United States, climate change is increasingly impacting homeowners’ and businesses’ ability to secure insurance in areas prone to extreme weather. But what about the skies? As global temperatures rise, the aviation industry faces unprecedented challenges:

NOAA, Climate.gov – Climate Change: Global Temperature Projections

Graph Overview: This graph presents historical global temperature trends alongside future projections based on different greenhouse gas emission scenarios. It effectively visualizes how varying levels of emissions could impact global temperatures through the year 2100.

- Increased Turbulence: Warmer air can lead to more unpredictable and severe turbulence.

- Heatwaves: Higher temperatures can affect aircraft performance, particularly during takeoff and landing. EASA

- Severe Storms: More frequent and intense storms can disrupt flight schedules and pose safety risks.

- Insight: Earth’s average surface temperature has increased by approximately 1.1°C (2°F) since 1880, with the rate of warming accelerating in recent decades. NASA Science, NOAA Climate.gov

Despite these risks, the Federal Aviation Administration (FAA) has yet to mandate that aircraft designs account for future climate projections.

🛩️ The Longevity and Cost of Aircraft

Commercial aircraft are significant investments, both in terms of cost and operational lifespan:

- Operational Lifespan: 20 to 30 years.

- Cost to Build: Ranging from $80 million to $400 million.

- Cost to Design a New Model: Between $20 billion and $50 billion.

Given these figures, it’s crucial that aircraft are designed with future climate conditions in mind to ensure safety and protect investments.

🌍 Global Efforts Toward Climate-Resilient Aviation

While the FAA has yet to implement stringent climate-related design requirements, other global bodies are taking proactive steps:

European Union Aviation Safety Agency (EASA)

- Certification Requirements: By January 1, 2028, all in-production aircraft must meet the International Civil Aviation Organization (ICAO) CO₂ standards.

- Climate Adaptation Initiatives: EASA has established the European Network on Impact of Climate Change on Aviation (EN-ICCA) to assess and address the effects of climate change on aviation safety. EASA

🔬 Innovations in Sustainable Aircraft Design

Several organizations are leading the charge in developing aircraft designed for a warmer, more volatile climate:

This graphic illustrates how global aviation emissions influence climate through contrails, greenhouse gases, aerosols, and cloud formation.

- NASA & MIT: (National Aeronautics and Space Administration and Massachusetts Institute of Technology) Collaborating on hybrid-electric aircraft designs aimed at reducing emissions and improving performance under extreme weather conditions.

- GE Aviation, Rolls-Royce, Pratt & Whitney: Investing in research to develop engines capable of operating efficiently in higher temperatures and more turbulent conditions.

- ZeroAvia: Pioneering hydrogen-electric powertrains for commercial aircraft, with successful test flights already conducted.

“Insight: As air temperature increases, air density decreases, leading to reduced lift and engine performance. This necessitates longer takeoff distances and can limit aircraft payload capacity. regionalclimateperspectives.com“

🛬 A Safer Flight Path Forward

While the aviation industry continues to innovate and lead in reducing CO₂ emissions, climate resilience and passenger safety must rise to the same level of urgency. Planes today are built for yesterday’s weather—but tomorrow’s skies are growing more turbulent, more unpredictable, and more extreme.

Just as we expect cars to be crash-tested and homes to withstand storms, aircraft must be designed with future climate risks front and center. Reducing emissions is vital—but so is ensuring that every traveler arrives safely, no matter what the climate throws our way.

✈️ If Europe is designing planes for tomorrow’s climate, why is the U.S. still flying in yesterday’s skies?

While both the FAA and EASA have established certification processes, EASA has taken more proactive steps in integrating climate resilience into aircraft design standards, including considerations for future temperature increases and extreme weather events.

🔗 References

- ⚖️ Comparative Regulations: FAA vs. EASA on Climate-Related Aircraft Design Standards vs. EASA on Climate-Related Aircraft Design Standards

- Our World in Data – Global aviation emissions

- International Civil Aviation Organization (ICAO) – Climate change standards

- European Union Aviation Safety Agency (EASA) – Design rules for climate resilience

- IEA – Transport emissions and trends

- MIT Sustainability – Hybrid-electric aircraft and emissions studies

- NASA – Sustainable Flight Demonstrator

- Our World in Data: Global aviation emissions

- EASA: Technology and Design

- EASA: Managing the impact of climate change on aviation EASA

- IEA: Aviation

- AI Assisted

#FlightSafety #ClimateChange #AviationInnovation #FAA #EASA #ZeroEmissionFlights #CleanSkies #FutureOfFlight #SustainableTravel #MITClimate #NASAInnovation #GlobalWarming #AirTravelRisk #EcoAviation #DesignForTomorrow #AviationSafety

Fossil Fuels Are Driving Insurance Into Crisis. It’s Time to Rethink Everything.

4/7/25

Climate change is no longer a looming threat—it’s already disrupting our lives, finances, and sense of security. From skyrocketing insurance premiums to extreme weather events that destroy homes and displace families, the signals are clear: our current energy model based on fossil fuels is unstable and unsustainable.

Firefighters hose down the burning remains of a structure in Altadena, California. Photograph: Caroline Brehman/EPA

This isn’t about blame. It’s about opportunity. We now face a pivotal moment where homeowners, business owners, and citizens can demand smarter investments that protect people—not just profits.

1. How Climate Change Is Driving Up Insurance Costs

Climate change is increasingly influencing the insurance industry, leading to higher premiums and reduced coverage availability as the frequency and severity of extreme weather events rise.

Correlation Between Extreme Weather and Insurance Premiums:

- Climate-Related Disasters: The increasing frequency and severity of climate-related disasters have led to significant economic losses worldwide. In 2022, such events resulted in $275 billion in economic losses, with only half of these losses being insured. This trend has contributed to rising insurance premiums and, in some cases, reduced availability of coverage in high-risk areas.Financial Times

- Deloitte (2030 projection): Homes in high-risk states could see premiums 24% higher than the national average.

These numbers are not forecasts—they’re real costs families are already shouldering.

2. Climate-Related Insurance Losses and the Fossil Fuel Paradox

Despite increasing claims from climate-induced damages, insurance companies continue to invest in the very industry accelerating those risks.

- Bloomberg (2023): Top insurers experienced $10.6 billion in climate-related losses—almost matching the $11.3 billion they earned from fossil fuel premiums.

- Insure Our Future Report: Many insurers still underwrite fossil fuel projects, despite the risk exposure.

Why invest in a model that causes the losses you’re insuring against?

3. Insurers Can Lead the Energy Transition

- World Economic Forum: Insurers have the power—and responsibility—to invest in renewable energy infrastructure. Doing so can reduce climate risks and help stabilize future premiums.

This is not just a financial opportunity—it’s a moral one.

4. The Bigger Picture: Financial Instability and a Warming World

If we fail to address the root cause—CO₂ from fossil fuels—we don’t just risk rising premiums or isolated disasters. We risk the collapse of our financial system.

- Günther Thallinger, Allianz Board Member / UN Net-Zero Asset Owner Alliance Chair:

“At 3°C of warming, damage costs will be so significant that it is doubtful they can be absorbed. Financial stability and capitalism as we know it are at risk.”

(Source: The Guardian)

This is not alarmism—it’s actuarial math.

5. What’s the Solution? Invest in Renewables, Not Risk

If 93% of total U.S. CO₂ emissions come from fossil fuels (EIA, 2023), we must prioritize immediate investment in cleaner energy options.

- EIA (2022): The U.S. provides $1 trillion in fossil fuel subsidies.

- IMF (2022): Globally, $7 trillion is spent annually on fossil fuel subsidies, including indirect costs like health impacts and environmental degradation.

That money should be funding:

- As many renewable energy solutions as possible, so cities are more climate-resilient.

- Insurance system reforms, where fossil fuel energy providers are not subsided and insured to rebuild the same fossil fuel systems that is causing our human, property and financial instability.

Let’s use public money for public good—not private pollution.

6. Even “Low-Risk” Areas Are Feeling the Heat

- Utah, USA (a midwestern state) saw a 59% increase in insurance premiums between 2021 and 2024.

(Source: Business Insider)

No state is immune. No family untouched.

7. What Can You Do? Be the Voice That Reshapes the System

If you’re tired of rebuilding, paying more, and feeling less secure, take action:

- Write your local city council, state representatives, and federal lawmakers.

- Ask them to shift funding from fossil fuel subsidies and insurance protection to new renewable energy projects and technologies.

- Tell them your community deserves solutions that protect your family, your home, and your future.

You deserve peace of mind. Your neighbors deserve stability. We all deserve a livable future.

In Closing:

“The climate crisis is not a threat to the future—it’s a threat to the present. And the cost of inaction is being paid by the many for the profit of the few.”

— Adapted from António Guterres, United Nations Secretary-General

We have the solutions. We have the funding. What we need now is the will—and your voice to make it happen: new and emerging renewableshostg.

Denise E. Hewes

AI Assisted

Instagram: 10x Your Sustainability

Youtube: Regenerative Solutions

Facebook: 10X Your Sustainability

Image References

- Boffey, Daniel. “US Homeowners in Disaster-Prone States Face Soaring Insurance Costs.” The Guardian, 22 Jan. 2025, https://www.theguardian.com/environment/2025/jan/22/us-homeowners-insurance-costs-climate-crisis. Accessed 7 Apr. 2025.

- “US$193bn Disaster Protection Gap in 2017: Swiss Re Sigma Report.” Reinsurance News, 28 Mar. 2018, https://www.reinsurancene.ws/193bn-disaster-protection-gap-in-2017-reports-swiss-res-sigma/. Accessed 7 Apr. 2025.

- Statista. “Cost of Climate-Related Disasters Soars 150%.” StatistaCharts, United Nations Office for Disaster Risk Reduction, https://www.statista.com/chart/18228/economic-cost-of-climate-related-disasters-over-20-year-periods/. Accessed 7 Apr. 2025.

- Statista. “Fossil Fuel Subsidies on the Rise: Volume of Global Fossil Fuel Subsidies (in Trillion U.S. Dollars).” StatistaCharts, International Monetary Fund, https://www.statista.com/chart/27894/global-fossil-fuel-subsidies-by-type/. Accessed 7 Apr. 2025.

- Stockholm Environment Institute. “Fossil Fuel Production Gap.” The Production Gap Report, 2019, https://productiongap.org/2019report/. Accessed 7 Apr. 2025.

- Statista. “Who Is Driving Investment in Renewable Energy?” StatistaCharts, based on data from UNEP; Bloomberg New Energy Finance; FS-UNEP Collaborating Centre, https://www.statista.com/chart/18684/investment-in-renewable-energy-by-country-region/. Accessed 7 Apr. 2025.

- Wärtsilä. “The Cost of Global Warming.” Yale Climate Connections, Jan. 2021, https://yaleclimateconnections.org/2021/01/world-hammered-by-record-50-billion-dollar-weather-disasters-in-2020/. Accessed 7 Apr. 2025.

#ClimateChange #Homeowners #FinancialStability #WeDeserveBetter #ClimateAction #GreenInfrastructure #CleanEnergyNow #RenewableEnergy #Decarbonization #SustainabilityMatters

What if the solution to climate change, poverty, and conflict in Africa could be grown—tree by tree? & watered by renewables. .

From coast to coast, a silent revolution is spreading across Africa’s drylands. It’s not fiction. It’s not theory. It’s real, and it’s happening right now.

🌿 “Powerful” energy solutions to Water Video Summary:

This stunning video takes you deep into the heart of the Great Green Wall—a visionary African-led initiative to restore 8,000 kilometers of land across the width of the continent. It tells a story of innovation where the key is water. Ocean water is desalinated using tidal and wave energy, then pumped inland via harvesting the power of moving vehicles—turning deserts green, reclaiming land, and revitalizing communities.

We witness how desalinated water brings forests back to life, how trees stop the desert’s advance, and how agriculture, livestock, and trade thrive under this new green infrastructure. From the regeneration of land to the rise of new economies, energy networks, and cross-border peacebuilding—this is Africa’s epic climate fightback.

This isn’t just environmentalism—it’s economic revival, cultural resilience, and a bold reimagining of Africa’s future. It’s not about surviving. It’s about thriving—together.

This is more than a wall of trees—it’s a wall of hope.

A movement rooted in collaboration, ingenuity, and fierce determination.

Watch the video. Share the message.

Because the story of the Great Green Wall is not just Africa’s story—it’s all of ours. 🌍

🔗 4. Credible External Links to Explore Further:

- 🌐 Official Great Green Wall Initiative – UNCCD

- 🌱 World Economic Forum: Africa is creating its own Great Wall – and it’s green

- 📽️ National Geographic Feature on Africa’s Great Green Wall

- 💡 TED Talk: How We Can Green the World’s Deserts and Reverse Climate Change – Allan Savory

Denise E. Hewes

Instagram: 10x Your Sustainability

Youtube: Regenerative Solutions

Facebook: 10X Your Sustainability

AI Assisted

#GreatGreenWall #ClimateAction #Reforestation #ClimateJustice #GreenAfrica #CombatDesertification #NatureRestoration #ClimateSolutions #SustainableFuture #EcoInnovation #GreenEconomy #RegenerativeAgriculture #RenewableEnergy #WaterSustainability #Desalination #AfricaRising #TogetherForAfrica #EnvironmentalJustice #GlobalSolidarity #ResilientCommunities #Documentary #EcoDocumentary #MustWatch #EcoAwareness #NatureMatters #ProtectOurPlanet

The Next Climate Crisis—Underground?

🌍 A Deeper Look at Geothermal Sustainability

3/30/25

We’re watching the skies for climate change—should we be watching underground too? Geothermal technology is a major breakthrough in the clean energy movement. Unlike solar and wind, which are intermittent, geothermal systems can provide constant energy—24 hours a day, 365 days a year. This continuous operation offers 4 to 6 times the energy output, making it one of the most efficient renewable sources available.

But here’s the catch: tapping into the Earth’s core heat on a large scale might have unintended consequences beneath the surface.

We may be on the verge of solving climate change above ground—

only to cause it below.

An educational diagram showing the process of geothermal energy, FreePik AI

Just as we’ve learned the cost of unregulated fossil fuel use, we must now ensure our solutions don’t create new problems—this time underground.

🛑 Could Geothermal Disrupt the Earth’s Stability?

Some experts are asking: Could removing too much heat from the Earth’s crust—especially in concentrated urban areas—impact tectonic stability? If geothermal projects are not properly distributed and monitored, especially near fault lines, high water injection zones, or extractive sites, they could risk triggering microseismic activity or other geological shifts.

Plate Tectonic Map – Plate Boundary Map

🧠 The Smart Solution: Tech-Backed Oversight

Luckily, we already have the tools to prevent this:

- Geological sensors

- Artificial Intelligence (AI) mapping

- Third-party scientific audits

We should use independent, global scientific associations to monitor geothermal sites in real-time. By creating a global geothermal map and balancing site locations, we can ensure sustainability without risking Earth’s inner stability.

Las Vegas Review-Journal, Google launching geothermal initiative in Nevada | Energy | Business

🤝 A Real-World Example: Google & Fervo Energy

Google, in partnership with Fervo Energy, built a geothermal plant feeding into the Nevada power grid to run its local data centers 24/7 with green energy. This is a perfect model for how corporations can adopt renewables. Are Google and Fervo monitoring the water quality for the town shown behind the man-made geothermal plant? The video below shows how the chemical can pollute and can be toxic in a deep geothermal process, potentially like the Google Geothermal plant.

🧠 Watch the video explaining how it works here: Google’s Controversial Geothermal Power Plant

🌐 Why This Matters

This isn’t just about science—it’s about planetary stewardship.

As geothermal technology gains momentum, we must ask deeper, long-term questions:

- Are we building a truly sustainable future—or merely shifting the environmental burden?

- Could geothermal drilling further strain our already limited potable water resources?

- What happens when we cluster these systems near dense urban regions? Could this increase the risks of sinkholes, land shifting, or even contribute to seismic activity—especially in earthquake-prone areas like California, the world’s sixth-largest economy?

While geothermal energy may seem self-sustaining, what happens when it intersects with multiple other human activities—like water drilling, mineral extraction, and infrastructure development? How do overlapping impacts affect ground stability, public safety, and our built environment?

Is Earth’s core heat infinitely renewable—or should we be more cautious?

As we move toward scaling renewable energy to meet 100% of our power needs, we must evaluate whether some technologies could unintentionally create hidden risks to our drinking water supplies and long-term infrastructure integrity.

There are solutions that work with nature—rather than pressing against its limits:

- 🇨🇭 Basel, Switzerland (2006): A deep geothermal project shut down due to induced seismic activity.

- 🌋 The Geysers, California: A long-running, well-monitored geothermal field offering valuable lessons in sustainable management.

- 🇮🇸 Iceland’s National Geothermal System: A model of balance—leveraging natural geothermal abundance through thoughtful national policy.

Futuristic Geothermal Monitoring System

A conceptual, AI-generated dashboard visualizing an integrated Earth systems monitoring interface. The image overlays geothermal energy tracking with real-time data on earthquakes, tectonic plate shifts, volcanic activity, deep-water drilling, and subterranean infrastructure development. This intelligent interface represents a future where AI and satellite technology collaborate to ensure safe, sustainable, and resilient energy and construction practices.

With the right strategy and oversight, geothermal energy can help us power a stable, livable planet—for everyone.

Let’s move forward with renewable solutions that don’t just look clean—but actually support the health of ecosystems, infrastructure, and future generations.

Additional Geothermal Information:

- U.S. Department of Energy: Geothermal Energy Basics

This resource provides an overview of geothermal energy, explaining its sources, technologies, and applications.

https://www.energy.gov/eere/geothermal/geothermal-basics - MIT Study on the Future of Geothermal Energy

A comprehensive assessment evaluating the potential of geothermal energy as a major energy source in the United States.

https://energy.mit.edu/research/future-geothermal-energy/ - Fervo Energy & Google Partnership

Details about the collaboration between Fervo Energy and Google to develop advanced geothermal energy projects.

https://blog.google/outreach-initiatives/sustainability/google-fervo-geothermal-energy-partnership/

By Denise E. Hewes

AI Assisted

Instagram: 10x Your Sustainability

Youtube: Regenerative Solutions

Facebook: 10X Your Sustainability

About.me = about.me/denise.hewes

Medium AI: https://medium.com/@saf_72881/the-next-climate-crisis-underground-1b3245392318

Linkedin: https://www.linkedin.com/pulse/next-climate-crisisunderground-denise-hewes-qeooc

https://10xsfl.com/news/f/the-next-climate-crisis—underground #GeothermalEnergy #RenewableEnergy #CleanTech#WaterSecurity #SustainableInfrastructure #ClimateResilience #PlanetaryStewardship #EarthquakeRisk #UrbanPlanning #EnergyTransition #EcoFutures #RegenerativeDesign #GreenEngineering #NatureBasedSolutions#EnvironmentalImpact

Empower Your “Energy”: “Empower” your Neighbors!”

🔌 Peer-to-Peer Energy Trading (via Blockchain)

3/25/25

Imagine selling your excess wind, solar geothermal or “emerging” energy directly to your neighbors, earning passive income while promoting a sustainable community.”

What’s New: Sell your extra algae, fuel cell, geothermal, wind, or solar power to your neighbors—secure and automatic via blockchain tech.

Why It’s Cool: No utility middleman. Total energy democracy. Savings + Passive Income: Earn credits or cash on surplus energy. Who’s Doing It: Powerledger (Australia), WePower, Brooklyn Microgrid.

Is Peer to Peer Renewables Trading a Growing Trend?

Yes, peer-to-peer (P2P) energy trading via blockchain is gaining momentum globally. The market is projected to grow at a compound annual growth rate (CAGR) of 25.55% from 2023 to 2028, driven by increasing energy demands and the need for real-time energy management. MarkNtel

Adoption in Europe, Africa, Asia, and China:

- Europe: Several European countries are actively testing blockchain-based energy trading. For instance, 23 major utility companies, including Enel SpA and RWE AG, have initiated blockchain programs to facilitate P2P trading. MarkNtel

- Asia: Countries like Japan and Malaysia have started trial P2P schemes, with many pilot projects utilizing blockchain technology. IRENA

- Africa: While specific large-scale implementations are limited, the potential for P2P energy trading is significant, especially in regions with underdeveloped centralized grids. World J. of Adv. Research & Reviews

- China: China is exploring blockchain applications in energy, focusing on enhancing transparency and efficiency in energy transactions. Nature

4.Associated Costs:

Implementing P2P energy trading involves several costs: World J. of Adv. Research & Reviews

Infrastructure Investment: Setting up blockchain platforms and integrating smart meters require substantial initial investments. Global Market Insights Inc.+1Polaris+1

- Maintenance and Operation: Ongoing costs include system maintenance, cybersecurity measures, and platform management.

- Transaction Fees: While blockchain reduces intermediaries, there are costs associated with transaction validations and network fees.

5. Potential Challenges:

Despite its advantages, P2P energy trading faces challenges:

- Regulatory Barriers: Existing energy regulations, designed for centralized systems, may not accommodate decentralized trading models. World J. of Adv. Research & Reviews

- Technological Hurdles: Ensuring scalability, security, and interoperability of blockchain platforms can be complex.

- Market Acceptance: Consumers and traditional utilities may be hesitant to adopt new trading models due to unfamiliarity or perceived risks.

6. Integration with Utility Companies:

P2P energy trading platforms often operate alongside traditional utilities. Some utilities participate in or support these platforms to enhance grid efficiency and customer engagement. Collaboration is crucial to ensure grid stability and compliance with regulatory standards. World J. of Adv. Research & Reviews

7. (Buckets more) External Resources for Further Reading:

- Powerledger: An Australian company pioneering blockchain-based energy trading solutions.

- WePower: A platform enabling green energy trading and investment in Estonia. Nature

- Brooklyn Microgrid: A community-driven initiative in New York, USA facilitating local energy trading.

Embrace the future of energy by exploring P2P trading platforms and contribute to a more resilient home, continuous work nationally and internationally, stable energy source, fewer grid fees, sustainable, empowered community and a more climate friendly future. Now that is one legacy worth living today!!.

10X Sustainable Work: Denise E. Hewes

Instagram: 10x Your Sustainability

Youtube: Regenerative Solutions

Facebook: 10X Your Sustainability

AI Assisted

#PeerToPeerEnergy #BlockchainEnergy #EnergyIndependence #SustainableFuture #RenewableRevolution #CleanEnergyTrading #EmpowerConsumers #DecentralizedGrid #GreenTech #EnergyDemocracy

🔋YOUR POWER is in YOUR HANDS!!

& a clean environment when you step out your door!!

3/22/25

Second-Life EV Batteries for Home Energy Storage

What’s New: Used electric vehicle batteries being repurposed as home or building storage units. Why It’s Cool: Super affordable compared to new Tesla Powerwalls. Sustainability Win: Reuse + backup energy + grid independence. Who’s Doing It: RePurpose Energy, B2U Storage Solutions (SoCal-based!), and Nissan.

🔋 Companies Doing Second-Life EV Battery Work

1. RePurpose Energy

What They Do: Takes used EV batteries and repurposes them into energy storage systems for buildings and communities.

🔗 https://www.repurpose.energy

2. B2U Storage Solutions

What They Do: Based in SoCal, B2U deploys second-life EV batteries in scalable storage systems to help reduce grid strain and enhance renewable energy use.

🔗 https://b2uco.com

3. Nissan x 4R Energy

What They Do: Nissan, through its joint venture 4R Energy, is a pioneer in reusing EV batteries from the Nissan LEAF to power homes, buildings, and even vending machines in Japan.

🔗 https://www.4r-energy.com/en

🔗 https://global.nissannews.com/en/releases/nissan-second-life-ev-batteries

AI Assist

#SecondLifeBatteries #CleanEnergyFuture #BatteryStorage #EnergyIndependence #GridResilience #ClimateAction #CircularEconomy #SustainableLiving #GreenTech #PowerTheChange #BrightFutures #EcoInnovation #ElectrifyEverything #GoodbyeFossilFuels #CheesyButTrue

Google X – Glows Green!

Google’s innovation lab, X (formerly Google X), has undertaken several ambitious projects in renewable energy and energy storage:

Malta: This project focused on developing a grid-scale energy storage system that converts electricity from renewable sources into thermal energy, stored in molten salt and chilled liquid. The stored energy can later be converted back into electricity to meet demand. In December 2018, Malta graduated from X to become an independent company.

X, the moonshot factory: Malta

Tapestry: Recognizing the complexities of modern electric grids, Tapestry aimed to develop tools for better visualization and management of the grid. The project focused on creating a shared understanding of electricity production, distribution, and consumption to facilitate the transition to a carbon-free, reliable electric grid.

X, the moonshot factory: Tapestry

These projects reflect X’s commitment to exploring innovative solutions in renewable energy and energy storage, addressing challenges from energy generation to grid management.

Beyond Google’s X projects, I’d love to see:

- Modular Gravity Storage: Using suspended weights in abandoned mineshafts to store and release energy.

- AI-Optimized Microgrids: Smarter, decentralized energy networks powered by renewables and controlled by AI.

- Seawater-Based Solar Panels: Research is Google’s innovation lab, X (formerly Google X), has undertaken several ambitious projects in renewable energy and energy storage:

Malta: This project focused on developing a grid-scale energy storage system that converts electricity from renewable sources into thermal energy, stored in molten salt and chilled liquid. The stored energy can later be converted back into electricity to meet demand. In December 2018, Malta graduated from X to become an independent company.

X, the moonshot factory: Malta

Tapestry: Recognizing the complexities of modern electric grids, Tapestry aimed to develop tools for better visualization and management of the grid. The project focused on creating a shared understanding of electricity production, distribution, and consumption to facilitate the transition to a carbon-free, reliable electric grid.

X, the moonshot factory: Tapestry

These projects reflect X’s commitment to exploring innovative solutions in renewable energy and energy storage, addressing challenges from energy generation to grid management.

Beyond Google’s X projects, I’d love to see:

- Floating Wave and Tidal: More compact and efficient under and along all the World ports, piers and industrial sectors for easier access, care and maintenance by staff already allocated for the areas.

- Electrified Roads: Roads that wirelessly charge EVs as they drive—Sweden is already piloting this!

- Modular Gravity Storage: Using suspended weights in abandoned mineshafts to store and release energy.

- AI-Optimized Microgrids: Smarter, decentralized energy networks powered by renewables and controlled by AI.

Resources

🔹 General Renewable Energy & Innovation

- IEA – International Energy Agency (Global energy trends, innovations, and policies)

- NREL – National Renewable Energy Lab (Leading U.S. lab for emerging renewable energy research)

- MIT Energy Initiative (Innovative research and industry collaboration)

- DOE Renewable Energy Office (Official U.S. government site on renewables)

🔹 Google X & Energy Projects

- Google X (Moonshot Factory) (Official site with current and past projects)

- Malta Energy Storage (Google X’s molten salt energy storage spinoff)

- Makani Airborne Wind Energy (Archived Google X wind energy project)

🔹 Emerging Renewable Tech

- Energy Vault (Gravity-based energy storage—better than batteries?)

- Heliogen (AI-driven solar thermal tech with industrial applications)

- Ocean-Based Renewables – Orbital Marine (Floating tidal energy technology)

#RenewableEnergy #CleanTech #ClimateTech #GreenInnovation #GoogleX #MoonshotEnergy #FutureOfEnergy #EnergyStorage #SmartGrid #GridResilience #GoogleSustainability #GoogleEnergy #GoogleXRenewables

- Electrified Roads: Roads that wirelessly charge EVs as they drive—Sweden is already piloting this!

- Floating Wind Turbines: More compact and efficient wind power that works in deep-sea environments.

Resources

🔹 General Renewable Energy & Innovation

- IEA – International Energy Agency (Global energy trends, innovations, and policies)

- NREL – National Renewable Energy Lab (Leading U.S. lab for emerging renewable energy research)

- MIT Energy Initiative (Innovative research and industry collaboration)

- DOE Renewable Energy Office (Official U.S. government site on renewables)

🔹 Google X & Energy Projects

- Google X (Moonshot Factory) (Official site with current and past projects)

- Malta Energy Storage (Google X’s molten salt energy storage spinoff)

- Makani Airborne Wind Energy (Archived Google X wind energy project)

🔹 Emerging Renewable Tech

- Energy Vault (Gravity-based energy storage—better than batteries?)

- Heliogen (AI-driven solar thermal tech with industrial applications)

- Ocean-Based Renewables – Orbital Marine (Floating tidal energy technology)

#RenewableEnergy #CleanTech #ClimateTech #GreenInnovation #GoogleX #MoonshotEnergy #FutureOfEnergy #EnergyStorage #SmartGrid #GridResilience #GoogleSustainability #GoogleEnergy #GoogleXRenewable

?Carbon Accounting Distraction? Why blame rich and businesses?

Instead of the Focusing on the real Culprits..

For years, businesses, airlines, and shipping industries have been hammered with carbon accounting responsibilities, emissions reporting, and climate regulations. But is this focus misplaced? While these sectors do contribute to greenhouse gas emissions, the root of the climate crisis—our global reliance on fossil fuels—remains largely unchecked. Why are we making businesses jump through hoops while the real issue remains untouched?

The Exhausting Burden on Businesses

The shift toward mandatory carbon accounting and emissions reporting has placed a massive financial and operational burden on businesses. Many companies are struggling with complex Scope 1, 2, and 3 emissions reporting, leading to skyrocketing compliance costs. Yet, despite these efforts, fossil fuel extraction and consumption continue at alarming rates. In fact, the top 100 fossil fuel producers account for over 70% of global greenhouse gas emissions since 1988. Why are we fixated on spreadsheets instead of solutions?

The Real Culprit: Fossil Fuels

Our energy systems remain predominantly fossil-fuel-based, with coal, oil, and gas still supplying over 80% of global energy. Businesses, airlines, and shipping industries are easy targets, but their emissions stem from an energy infrastructure that leaves them with few viable alternatives. When governments become truly aware about tackling climate change, the focus would be on accelerating the transition to renewable energy rather than penalizing businesses for operating within a flawed system.

Airlines and Shipping: Scapegoats or Solutions?

Airlines and shipping industries are frequent targets for climate activists, yet they only account for 2.5% and 3% of global CO₂ emissions, respectively. Meanwhile, road transport and electricity production each account for over 25% of global emissions. If cutting emissions is the goal, shouldn’t we prioritize decarbonizing energy grids and public transport before punishing industries that have no viable low-carbon alternatives yet?

Where Should the Focus Be?

Instead of placing excessive pressure on businesses, regulators and policymakers should direct their efforts toward:

- Phasing out fossil fuel subsidies – Governments still provide $7 trillion in subsidies annually to the fossil fuel industry.

- Massive renewable energy expansion – Investment in emerging renewables and nature based storage solutions needs to triple by 2030.

2025 Must-Attend ESG Events! . . . for ESG tools & innovative . .

2025 Must-Attend ESG Events! . . . for ESG tools & innovative solutions

Corporations aiming to enhance their Environmental, Social, and Governance (ESG) reporting and stay abreast of emerging technologies and tools have several avenues to explore, including conferences, webinars, and online resources. Here are some notable opportunities:

Conferences and Summits:

- Sustainability Data America 2025: Scheduled for May 14, 2025, in New York, this conference focuses on efficient utilization of sustainability data to streamline compliance reporting and harness AI’s potential in ESG practices.

environmental-finance.com - 2nd Annual World ESG and Climate Summit: Taking place on May 13-14, 2025, in Amsterdam, Netherlands, this hybrid event gathers global leaders to discuss ESG integration, climate finance, and sustainable innovations.

leadventgrp.com - 2025 Corporate Responsibility Summit: Organized by The Conference Board on April 24-25, 2025, this summit examines board responsibilities in overseeing ESG metrics and integrating them into corporate performance evaluations.

conference-board.org

Webinars and Online Resources:

- “Harnessing ESG Reporting Software to Simplify Compliance”: An on-demand webinar by Pulsora and Kainos offering strategies for adopting ESG reporting software to streamline compliance workflows.

pulsora.com - “The Future of ESG Reporting: Automated, Accurate, and Impactful”: A session by TimeXtender and KPMG focusing on best practices for implementing the Corporate Social Responsibility Directive (CSRD) and capturing sustainability data.

timextender.com - “Demystifying ESG Webinar Series”: Hosted by Baker McKenzie, this series provides insights and practical guidance for businesses exploring ESG integration and reporting.

bakermckenzie.com

Engaging with these events and resources can equip corporations with the knowledge and tools necessary to enhance their ESG reporting and effectively communicate their sustainability efforts to stakeholders.

AI Assisted

Al Gore’s Fire exposes fossil-fueled puppet show behind World . .

Al Gore’s Fire Video, click here. 2.49 seconds

Al Gore’s recent speech at COP29 highlighted the significant influence of the fossil fuel industry on global climate negotiations, underscoring the urgent need for systemic change. To promote positive and expedited action, consider the following steps or

– email us and we can do it for you, on your behalf:

1. Advocate for Ethical Leadership Reviews

Engage directly with key organizations to demand ethical evaluations of their leadership and processes:

- World Bank: Contact President Ajay Banga to express concerns and request an ethical review of the institution’s leadership.

- Mailing Address: The World Bank

1818 H Street, NW

Washington, DC 20433 USA - Phone: +1-202-473-1000

- Email: president@worldbank.org

- Mailing Address: The World Bank

- UNFCCC (COP Organizers): Reach out to the UNFCCC Secretariat to advocate for transparency and ethical assessments of conference leadership.

- Email: secretariat@unfccc.int

- Phone: +49-228-815-1000

2. Support Environmental Organizations

Align with groups dedicated to climate justice and systemic reform:

- Friends of the Earth: An international network striving for a more sustainable and just world.

- Website (click here): Friends of the Earth

- Climate Action Network (CAN): A global network of over 1,500 NGOs working to promote government and individual action to limit human-induced climate change.

- Website (click here): Climate Action Network

3. Participate in Climate Advocacy

Engage with national and international groups to amplify your voice:

- 350.org: A global grassroots movement aiming to reduce atmospheric CO₂ levels to a safe 350 parts per million.

- Website (click here): 350.org

- Sunrise Movement: A youth-led organization advocating for political action on climate change.

- Website (click here): Sunrise Movement

4. Stay Informed and Educate Others

Knowledge is a powerful tool for change:

- Carbon Tracker Initiative: Provides in-depth analyses of the financial implications of climate change.

- Website (click here): Carbon Tracker

- Inside Climate News: An independent, nonprofit news organization covering climate, energy, and the environment.

- Website (click here): Inside Climate News

By taking these actions, individuals can contribute to the momentum needed to address the systemic issues highlighted in Al Gore’s speech and work towards a more ethical and sustainable future.

For a deeper insight into Al Gore’s perspective, you might find this video informative:

Sources

For a deeper insight into Al Gore’s perspective, you might find this video informative:

Al Gore’s Climate Reality Perspective, click here: Al Gore’s 2nd video link(25 minutes)

AI Assisted

Share this post:

Solving 69% of Fossil Fuel Problems: The Fast-Track Blueprint

Solving 69% of the problems caused by fossil fuel use requires a multi-pronged approach combining technology, policy, and financing. Here’s how I’d break it down:

1. Funding Strategy

To achieve large-scale decarbonization, funding needs to come from multiple sources, leveraging public and private investments. Potential sources include:

✅ Government Grants & Subsidies

- Inflation Reduction Act (IRA) funding for green infrastructure

- DOE’s Loan Programs Office (LPO) for scaling innovative clean tech

- Global carbon pricing and tax revenues (redirected into R&D and deployment)

✅ Green Bonds & Impact Investment

- Expansion of Green APPLE Bonds for public infrastructure

- Climate-focused venture capital & impact investors (Breakthrough Energy, Lowercarbon Capital)

- Institutional investors (pension funds, endowments) targeting ESG portfolios

✅ Public-Private Partnerships

- Companies + cities co-funding clean energy transitions

- Utility-scale projects backed by corporations with net-zero targets

✅ Carbon Markets & Tax Incentives

- Strengthen cap-and-trade programs to drive down emissions

- Carbon credits funding nature-based solutions & DAC (direct air capture)

2. Key Technologies to Piggyback

Rather than reinventing the wheel, piggybacking on existing and emerging technologies will accelerate the transition.

(A) Energy Decarbonization (40% Impact)

🔹 Renewable Energy Scale-Up

- Offshore/onshore wind, floating solar, perovskite PV, and geothermal

- Advanced nuclear (small modular reactors, fusion R&D)

🔹 Grid Modernization & Storage

- AI-driven grid balancing (e.g., Google’s DeepMind AI for energy efficiency)

- Long-duration energy storage (gravity batteries, liquid metal, green hydrogen)

🔹 Transmission Infrastructure Expansion

- HVDC supergrids linking renewables across states/countries

(B) Transportation Revolution (20% Impact)

🔹 EV Transition & Charging Networks

- Expansion of federal EV tax credits & fleet electrification

- Wireless road charging, battery swapping, and sodium-ion batteries

🔹 Electrified Rail & Public Transit

- High-speed rail (piggyback on China/EU systems)

- Expanded subway and light rail networks in major cities

🔹 Sustainable Aviation & Shipping

- Piggyback on e-fuels & hydrogen-based aviation (Airbus, Boom Supersonic)

- Methanol & ammonia for maritime decarbonization (Maersk’s methanol fleet)

(C) Industrial & Building Decarbonization (9% Impact)

🔹 Green Steel, Cement, & Manufacturing

- Piggyback on hydrogen-based steelmaking (HYBRIT, H2 Green Steel)

- Low-carbon cement (CarbonCure, biochar-infused concrete)

🔹 Energy-Efficient Buildings

- Passive house designs, advanced insulation, smart HVAC systems

- District heating networks using waste heat recovery

(D) Carbon Capture & Nature-Based Solutions (5% Impact)

🔹 Direct Air Capture (DAC) & Biochar Sequestration

- Piggyback on Climeworks, Carbon Engineering, Charm Industrial

🔹 Reforestation & Soil Carbon Sequestration

- Expand agroforestry, regenerative farming, and mangrove restoration

3. Policy & Market Mechanisms

Even the best technology won’t be deployed without policy support. To ensure adoption:

✅ Carbon Pricing: Stronger cap-and-trade or carbon taxes

✅ Stronger EPA Regulations: Methane limits, industrial decarbonization mandates

✅ Green Public Procurement: Mandates for sustainable materials in government contracts

✅ R&D Tax Credits: Encouraging startups to innovate in decarbonization

Final Takeaway: How Do We Get to 69% Reduction?

By strategically funding high-impact areas and piggybacking on existing technologies, we can decarbonize energy (40%), transport (20%), industry & buildings (9%), reaching the 69% reduction threshold.

Resources

1. Funding Strategy

- Inflation Reduction Act (IRA) Funding – https://www.whitehouse.gov/cleanenergy

- DOE Loan Programs Office (LPO) – https://www.energy.gov/lpo

- Green Bonds Overview (Climate Bonds Initiative) – https://www.climatebonds.net

- Breakthrough Energy Ventures – https://www.breakthroughenergy.org

- Global Carbon Pricing (World Bank Carbon Pricing Dashboard) – https://carbonpricingdashboard.worldbank.org

2. Key Technologies to Piggyback

- Renewable Energy Growth (IRENA Report) –https://www.irena.org/Publications

- HVDC Supergrids & Grid Modernization – https://www.energy.gov/oe/activities/technology-development/grid-modernization

- Perovskite Solar Advances (NREL Research) – https://www.nrel.gov/pv/perovskite-solar-cells.html

- Electric Vehicles (EV) Tax Incentives – https://www.fueleconomy.gov/feg/taxcenter.shtml

- High-Speed Rail Developments (U.S. High-Speed Rail Association) – https://www.ushsr.com

- Sustainable Shipping Innovations (Maersk Green Methanol Fleet) – https://www.maersk.com/news/articles/2023/06/26/maersk-orders-six-methanol-powered-vessels

- Green Steel (HYBRIT Project) – https://www.hybritdevelopment.se/en/

- Carbon Capture & Direct Air Capture (Climeworks) – https://climeworks.com

3. Policy & Market Mechanisms

- Carbon Pricing & Cap-and-Trade Programs (Carbon Tax Center) – https://www.carbontax.org

- R&D Tax Incentives (DOE Office of Science) – https://www.energy.gov/science

- EPA Regulations for Methane Reduction – https://www.epa.gov/ghgreporting

#ClimateAction

#CleanEnergy

#Decarbonization

#GreenTech

#NetZero

#GreenBonds

#ImpactInvesting

#SustainableFinance

#ESGInvesting

#CarbonMarkets

#RenewableEnergy

#EVRevolution

#EnergyStorage

#GridModernization

#CarbonCapture

AI Assisted

Share this post:

The 69% Problem Driving Climate Change: Fossil Fuels &

Several reputable organizations have reported that a significant majority of greenhouse gas (GHG) emissions originate from the combustion of fossil fuels. For instance, the U.S. Energy Information Administration (EIA) states that in 2022, fossil fuel combustion was responsible for about 74% of total U.S. human-caused GHG emissions.

Similarly, the U.S. Environmental Protection Agency (EPA) highlights that the transportation sector, which relies heavily on fossil fuels, is a major contributor to GHG emissions.

Furthermore, the International Energy Agency (IEA) notes that fossil fuels continue to represent 81% of the total energy supply globally, underscoring their significant role in GHG emissions.

These findings align with the EIA’s data, emphasizing the substantial impact of fossil fuel consumption on greenhouse gas emissions.

#GreenhouseGasEmissions #FossilFuels #ClimateChange #CarbonEmissions #GlobalWarming #Sustainability #RenewableEnergy #EnvironmentalImpact #CleanEnergy #ClimateAction

AI Assisted..

Share this post:

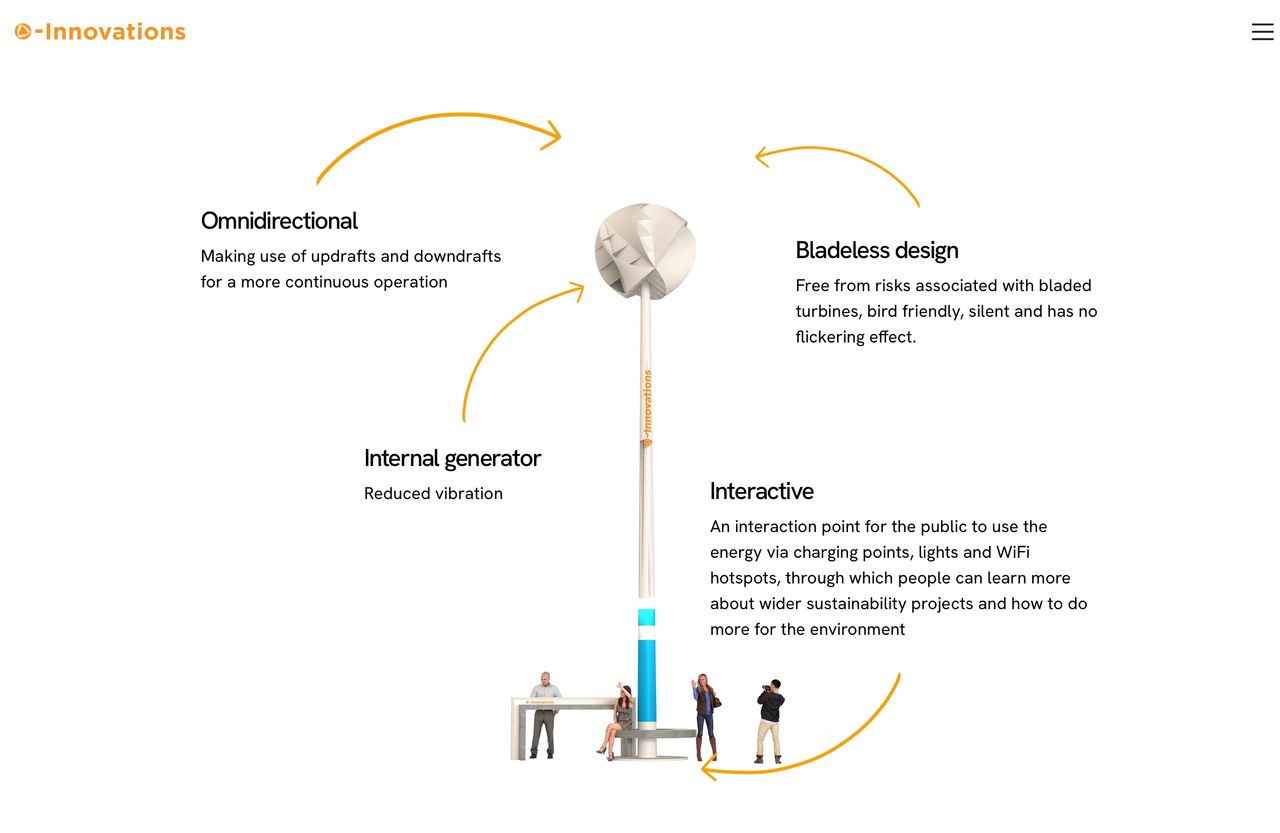

O-wind’s = Urban 6 directional energy harvesting possible?

Not only, possible, but powerfully applicable and powerfully ready to address man-made climate change.

Fun! Everyone can have their own renewables, today! In my opinion they seem perfect for urban environments, on multifamily building’s balconies with their own power charger as a way to circumvent brownouts in California and keep businesses running 24 hours a day.

Omni-directional harvests wind from all directions. Where traditional wind turbines harvest energy only from one direction. That is 6 times the potential of more energy to harvests! That makes the O-wind potentially 6 times more cost effective than traditional wind turbines. Additionally, the O-wind’s ability to harvest multidirectional wind opens up many opportunities for its use in the most unusual locations and close to sources of energy needs. For example, it is a great technology for use on almost any building located near freeways, as the high rates of speeds and swirling winds off cars, trucks, van and any moving vehicle almost 24 hours per day and 365 days per year increases the energy harvesting times. This also makes O-wind a more consistent renewable energy source than intermittent wind and solar approximately 6 hours of harvest time per day for solar, as stated on the California Energy website. From the James Dyson Award it was determined that, “(Nicholas & the Judges) concluded that it would be logical for it to be situated in densely populated urban areas to harness the chaotic urban winds.”

Could all these Accolades be wrong? NO, this is a very very applicable technology!

O-Innovations received:

– The James Dyson Award

– WorldLabs Elevating Ideas Award

– Strait of Magellan Award for Innovation and Exploration with Global Impact

– Santander Universities Award

– Design Intelligence Award

– Siemens Ingenuity Award

– Shenzhen Innovation & Entrepreneurship International Competition Award

– Innovation and Entrepreneurship Competition for Overseas Talents Hangzhou

#renewable energy

#emerging Technologies

#climate change

Stepping Up the Step-Up Game of Regenerative Flooring: Possible? Yes!

Let’s Go Triboelectric! ⚡

Triboelectric technology harnesses energy from movement—specifically, the interaction between two materials. Scientists are now generating electricity from wood, opening new possibilities for sustainable energy solutions.

How Does It Work?

- Triboelectric Effect: When two materials come into contact and separate, they can generate an electric charge.

- Why Wood?

- Traditionally triboneutral (doesn’t naturally transfer charge).

- More sustainable than step-harvesting technologies using metals or synthetic materials.

- The Breakthrough:

- Scientists infused one piece of wood with silicon (which picks up electrons).

- The other piece was treated with nanocrystals of Zeolitic Imidazolate Framework-8 (ZIF-8) (which gives up electrons).

- This enhanced wood 80x more efficient at transferring energy than untreated wood!

🔗 Read more on the technology: NewScientist

Why It Matters 🌍

- Energy Harvesting: Captures waste energy from footsteps to power small devices.

- Scalability: Scientists say it’s commercially viable and can scale for mass use.

- Material Sustainability:

- Wood is renewable & biodegradable compared to metals and synthetics.

- Future coatings might replace direct infusion, making production cheaper & easier.

- At end-of-life, coatings are likely less chemically harmful to remove than infused materials.

Key Questions for the Future 🔍

- Durability: How long does the flooring last before losing efficiency?

- End-of-Life Management: What happens to infused wood when it stops generating charge?

- Energy Output: How does its energy production compare to other step-harvesting technologies?

- Material Intensity: How much less resource-intensive is this compared to metal-based options?

Regardless, this is a progressive step in sustainable energy! Harvesting unused energy from human movement is a powerful innovation. Kudos to the scientists pushing boundaries! 👏

#RenewableEnergy #SustainableTech #CleanEnergy #EnergyHarvesting #Triboelectric #GreenInnovation #SmartFlooring #EcoFriendly #FutureTech #SustainabilityMatters #StepPower

AI Assisted

Walking Power Harvesting, It’s Here!

5/8/23

People Power. There are all sorts. Today’s topic is capturing billions of walking, running, skipping, jumping, dancing people

Pavegen is one company that is renewable floor technology that captures the power of people generally walking. Or, moving in all forms and fashions across sidewalks, bus and rail stations, disco techs, soccer fields, busy urban streets, and auto manufacturing facilities.

Their product is located in 9 countries and 200 sites. Such locations and applications include:

- Korea: Kia Motor Factories

- Nigeria: Soccer fields

- Rio de Janeiro, Brazil: Public Infrastructure project

- USA and London: Westfield Shopping Center

- Oxford, England: Oxford Street

How much energy does it capture?

One foot step = 20 seconds of light of an LED light filament.

Because, Pavegen converts step energy, tracks users with an app, and provides rewards based on the amount of energy it produces. There are additional benefits beyond renewable energy harvesting. The benefits include, but not limited to: heat mapping and tracking of customers in retail spaces which can be a huge game changer alone to get this sort of data: I smell buckets of money when this is ultra analyzed for another layer of customer satisfaction tracking!

Here is there link if you would like to learn more about Pavegen, how the pavers work and the company: https://www.pavegen.com

# renewable energy solutions # climate change # ESG #CSR, #Sustainability

Energy = Heroes, Villains, redefining Victors?

4/12/23 – Post

Energy has allowed us, humankind, great freedom from toil. Scientific global data is showing how we are using old forms of energy production defines us as Climate Change Villains, today. We are in the process of redelivering to redefine us as victors.

Energy partnerships for those whom energy serves; consumers want massive change. Society says we want less harmful renewables, like all products, to in every aspect of development to be in the best service to living kind.

We do have the “power” to change current energy sources for the BEST of mankind, living-kind, and allow it to continue to be largest Global GDP producer. Political puppet strings here is needed to drive change. Those things that need to be driven and who are listed here below.

1) Include a least harm ranking of energy sources on human, water, and biosphere health, including food production.

2) All costs ranking review: extraction to end use, to production and distributive energy

3) Energy Output vs. $$$ life cycle costs analysis

4) Using various forms of 3rd party verifiers

5) Use AI to make this easier and faster for analysis and market entry

6) Use AI as a 4th party verifier

Here and below are a few reasons why the full cost balance sheet for a faster transition of our energy systems needs to be done and can be done. Lessons learned from Chernobyl (1986 meltdown) and Fukushima (1911 meltdown).

I walked alongside the agricultural fields in Poland in 1995 after the Chernobyl meltdown with Polish professors from a local University as a part of Appalachian State University’s Geography departments Graduate and Undergraduate Group. The Polish Professors pointed out the valley farm fields explaining to us that 3 times the radioactive material collected in what once was the most fertile lands are now the most toxic due to rain water and wind blowing sediments in these areas. They further explained how they were seeing an increase in birth defects due to this radioactive material.

Solutions: a valuable icon for change for decades, Project Drawdown is ranking renewable energy and climate change solutions. As we iterate on ESG reporting for businesses, I hope to see very quickly their next iteration, like the Europeans are starting to incorporate, multiple levels of least harm benefits to their solutions ranking. Their rankings would change based on the long term physically harmful effects when a renewable energy solar plant melts down relative to a nuclear power plant meltdown. And, a monetary calculation summary would make it understandable in any country, language, or industry.

Why rapid solutions, i.e. Climate Change Victors are possible: Africa has technologically jumped BOTH the need for phone lines and banking systems through the use of cellphones. We have the market ready technologies to jump even the need for biofuels as a fuel burning source, that put 1/3 C02 and GHG gasses into our atmosphere. . .

Are we asking ourselves the ALL of the right questions? . . . We just need to be able to put as much “energy” and “shine a light” on these heroic and victorious climate change solutions. These solutions need to be included in clearly defined time frames and protected by supporting financially political framework. This framework can be demanding and allowing US fledgling renewable energy sectors to become resilient enough to protect themselves from OPECs strategic drop in oil prices that wiped out many emerging renewables during the Obama Presidency.

Through time we have protected our babies from fire, until they learn to protect themselves. Based on new knowledge, global climate change scientific data, these are just a few ways we as an evolving society can transition from Energy Heroes, Villains, to Victors again.

full article located at https://rrenewables.com/2r-news/

https://drawdown.org/solutions/table-of-solutions

https://press.un.org/en/2005/dev2539.doc.htm

https://apnews.com/article/japan-fukushima-nuclear-radioactive-wastewater-release-fdaed86a7366f68c70eca0397b71b221

#energyproblems, # energysolutions, # emergingrenewablesolutions, #renewableenergy, #fulllifecycleanalysis, #ESGreporting, #CSR, #Sustainability, #cradletograve #emergingrenewables

Profit from a Global Plague = Algae!

3/22/23

Yes, Global Plagues of Algae as another 80% C02 fuel source!?

“SAF is a liquid fuel currently used in commercial aviation which reduces CO2 emissions by up to 80%. It can be produced from a number of sources (feedstock) including waste oil and fats, green and municipal waste and non-food crops.”

LAX and San Diego and many other airports are located along the coast around the world. Why not try algae conversation right at the airports to achieve additional C02 reduction goals?

https://www.iata.org/en/programs/environment/sustainable-aviation-fuels/

? AI, Marketing, Social Media, Startups, Blockchain, Human Resources and IT?

2/10/23 – Post

how many of you think ESG (Environmental, Social, and Governance) will impact it?

Regulatory requirements intensify with European Union’s (EU) Corporate Sustainable Reporting Directive (CSRD). . . .

Top takeaway with ESG reporting requirements in the EU, European Union, for large organizations. And, a large organization is defined as having 50 million in net turnover. €25 million in assets. 250 or more employees.

CSRD, Corporate Sustainable Reporting Directive is replacing NFRD, Non-financial reporting directives.

Three expansions of CSRD from predecessor ESG regulations:

1) Reporting on water resources and biological diversity, gender and workforce diversity including working conditions in the social reporting.

2) Third party auditing from assurance and reliability reporting with clearly written documented and assumptions. For example, renewable energy goals need to be based on current renewable technologies, not projected technologies to keep businesses legally compliant.

3) Double materiality reporting of finance and environmental impact.

Additional ESG inclusion in CSRD reporting are:

1) Supply chain discussion and influence

2) Board Room and C-suite ESG Accountability

3) Global companies working in Europe need to report. Firms should also be keep an eye on the increasing regulations of the US Security and Exchange Commission and the State of California regulations.

4). Firms reporting on CSRD need to have mitigation plans in place in addition to their ESG goals

Reporting frameworks are seeing that businesses reporting on Scope 1 C02 emissions are easily achieved by using calculations from utility bills. It is picking applicable materiality of social and governance aspects that are confusing businesses.

Manufacturing, transportation and construction will have larger Scope 1 reporting work. While businesses with larger supply chains will have more complex measuring and planning of Scope 3 objects.

Even though ESG should be communicated through the organization as a whole most of the responsibility of CSRD reporting for the Fortune 1000 businesses and organizations are overseen by Sustainability Officers. While CFO’s will generally be responsible for overseeing the financial materiality of CSRD.

A very strong foundational requirement will need to be overseen by the IT department states this article, because if high quality data is not collected then all the goals, planning and time could become inappropriately placed for the investors and consumers reviewing this information.

12/18/23, Jim O’Donnell, News Writer of Regulatory requirements intensify with EU’s CSRD

https://www.techtarget.com/sustainability/feature/366563697/Regulatory-requirements-intensify-with-EUs-CSR

9/25/23 – Post

Emerging trends in Aviation Bio-fuel production.

The Airplane web of fuel production and use:

The next level for C02 reduction for airplane biofuels use is onsite or nearby airport owned or contracted airport production. Many airports are located along the coast. The World Health Organization (WHO) states that 60% of the global population is located along the coast, and so too are airports supporting these populations for business and travel needs. Airports can more readily acquire algae for biofuel conversation for airplane fuel from the local coastlines.

For example, in California, the sixth largest economy in the world, Los Angeles Airport (LAX), Santa Monica Airport, San Diego Airport, Long Beach Airport, and John Wayne Airport are located on or near the coastline. Why is this important? There is an cost and a C02 reduction advantage when compared to large scale solar and wind farms. They are generally located hundreds of miles away requiring long distribution lines to transport the fuel to consumers.

Startups and the Sustainable Aviation Buyers Alliance could consider these additional factors when providing biofuel for Airplane use,

Advantages:

More reliable source of fuel available. Mitigating fuel supply disruption due to increasing storms, pandemics, flooding along any portion of transport vehicles path.

Additional airport revenue streams. Should another pandemic happen and consumer airplanes are grounded, they can still sell the fuel to hospitals for ambulances and backup generation when their need increases due to the pandemic, fire departments, power companies, and basic needs food distribution trucks to grocery stores and food deliver units.

During Bull Markets, should there by excess or fuel is selling at higher prices in local retail space, airports can sell this onsite algae fuel production to nearby hotel buses, vans, and courtesy vehicles, and taxi cabs that bring the continuous streams of flyers 24 hours a day 365 days per year.

– Additional financial resiliency: Airports would also have another advantage to selling algae converted fuels on site at the airport during after business hours and capture local airport support transport fuel needs.

Disadvantages:

The main disadvantage to onsite algae biofuels production at airports is safety. Two mitigating steps could be building the facilities underground. Underground construction increases facility startup costs. Another alternative is to build the algae biofuel facility nearby, after a cost and risk analysis dictates which is safer and more financially viable at certain distance away.

Home

#bio-fuels, #C02reduction, #sustainability, #resiliency, #climatechange, #climatechangesolutions, #solutions, #emergingbusinesses, #startups, #entrepreneurs, #revenuestreams

COVID-19 is awful. Climate change could be worse.

By Bill Gates Click here to read more . . .

Oil Giants Invest $110 Billion In New Fossil Fuels After Spending $1 Billion On Green PR

Exxon Mobil Corp., Royal Dutch Shell, Chevron, Total and BP together have spent more than $1 billion on public relations since the Paris Agreement.

Click here to read more . . . . click here

2/10/24 – Post

? When it comes to AI, Marketing, Social Media, Startups, Blockchain, Human Resources and IT how many of you think ESG (Environmental, Social, and Governance) will impact it?

Regulatory requirements intensify with European Union’s (EU) Corporate Sustainable Reporting Directive (CSRD). . . .

Top takeaway with ESG reporting requirements in the EU, European Union, for large organizations. And, a large organization is defined as having 50 million in net turnover. €25 million in assets. 250 or more employees.

CSRD, Corporate Sustainable Reporting Directive is replacing NFRD, Non-financial reporting directives.

Three expansions of CSRD from predecessor ESG regulations:

1) Reporting on water resources and biological diversity, gender and workforce diversity including working conditions in the social reporting.

2) Third party auditing from assurance and reliability reporting with clearly written documented and assumptions. For example, renewable energy goals need to be based on current renewable technologies, not projected technologies to keep businesses legally compliant.

3) Double materiality reporting of finance and environmental impact.

Additional ESG inclusion in CSRD reporting are:

1) Supply chain discussion and influence

2) Board Room and C-suite ESG Accountability

3) Global companies working in Europe need to report. Firms should also be keep an eye on the increasing regulations of the US Security and Exchange Commission and the State of California regulations.

4). Firms reporting on CSRD need to have mitigation plans in place in addition to their ESG goals

Reporting frameworks are seeing that businesses reporting on Scope 1 C02 emissions are easily achieved by using calculations from utility bills. It is picking applicable materiality of social and governance aspects that are confusing businesses.

Manufacturing, transportation and construction will have larger Scope 1 reporting work. While businesses with larger supply chains will have more complex measuring and planning of Scope 3 objects.

Even though ESG should be communicated through the organization as a whole most of the responsibility of CSRD reporting for the Fortune 1000 businesses and organizations are overseen by Sustainability Officers. While CFO’s will generally be responsible for overseeing the financial materiality of CSRD.

A very strong foundational requirement will need to be overseen by the IT department states this article, because if high quality data is not collected then all the goals, planning and time could become inappropriately placed for the investors and consumers reviewing this information.

12/18/23, Jim O’Donnell, News Writer of Regulatory requirements intensify with EU’s CSRD

https://www.techtarget.com/sustainability/feature/366563697/Regulatory-requirements-intensify-with-EUs-CSR